modified business tax nevada due date

Qualifying employers are able to apply for an abatement of 50 percent. The 31st Special Session of the Nevada Legislature enacted Senate Bill 3 which provides for a one-time tax amnesty program for businesses or individuals doing business in.

State Of Nevada Department Of Taxation Ppt Video Online Download

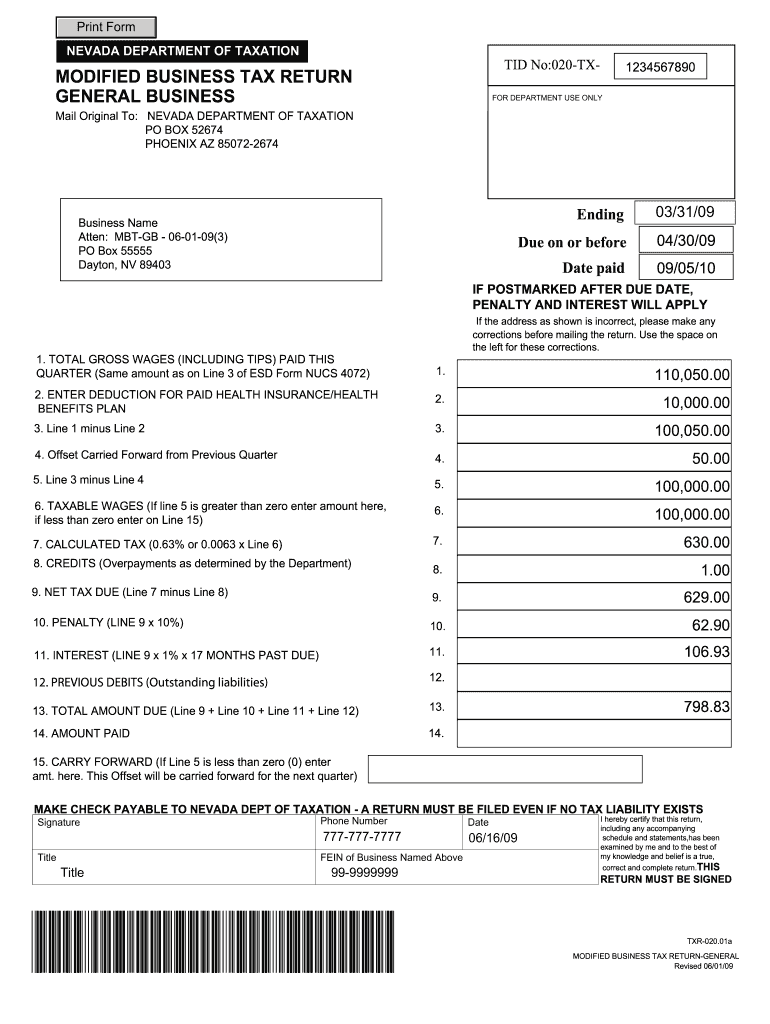

Nevada levies a modified business tax mbt on payroll wages.

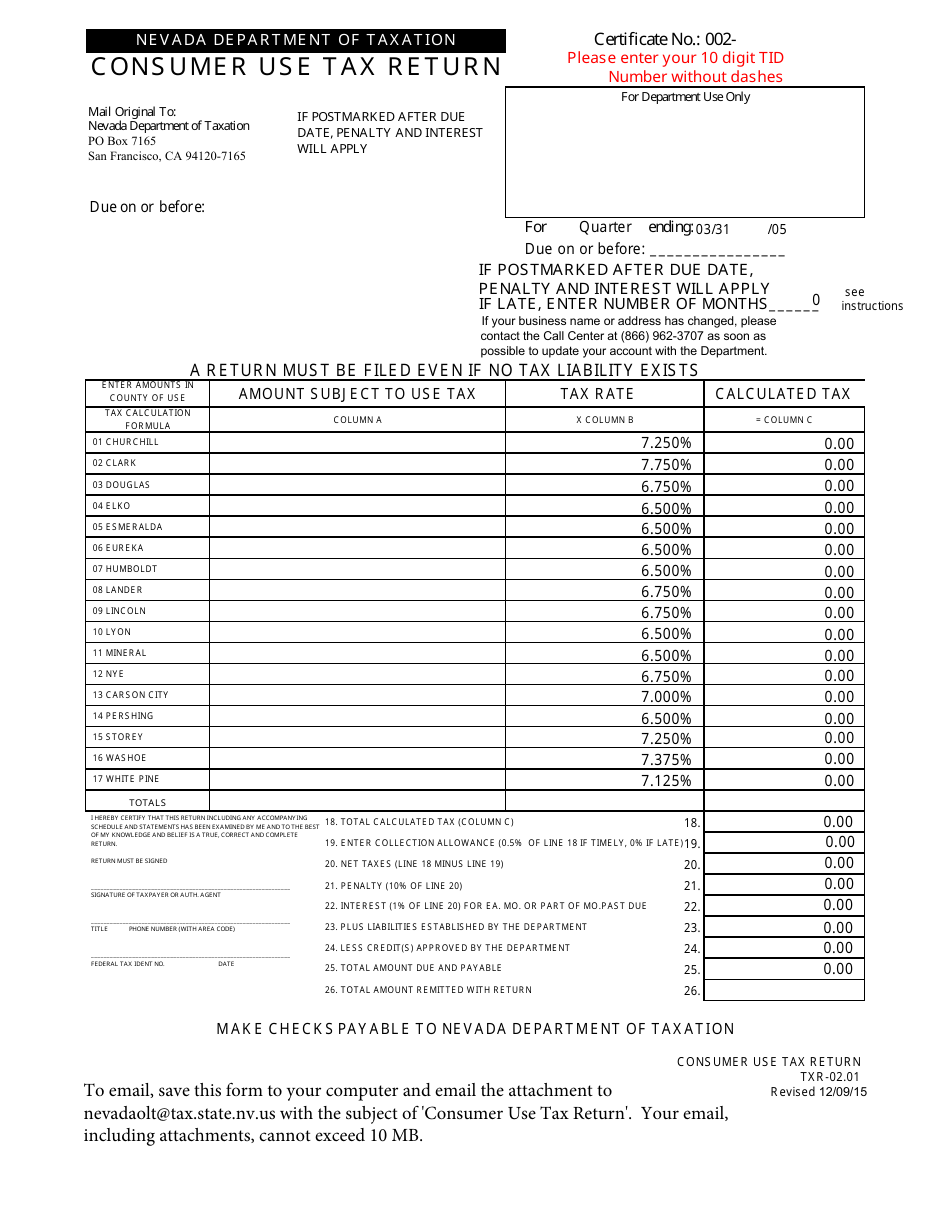

. There are three ways to report tax fraud. It will contain every up-to-date form application schedule and document you need in the city of Smith the. If the due date falls on a weekend or holiday the return is due on the next.

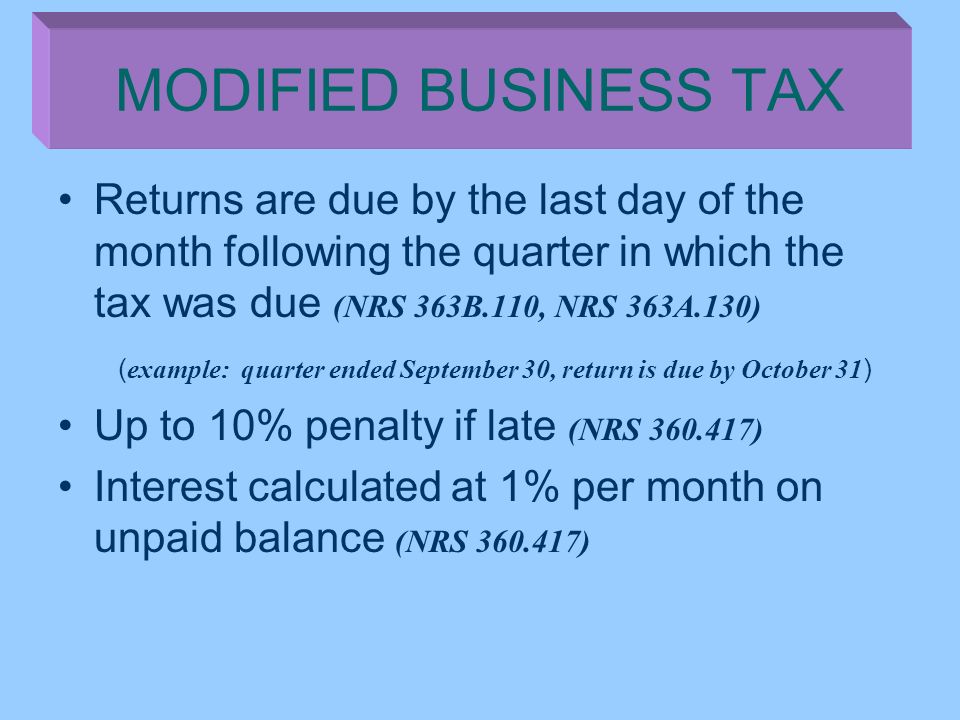

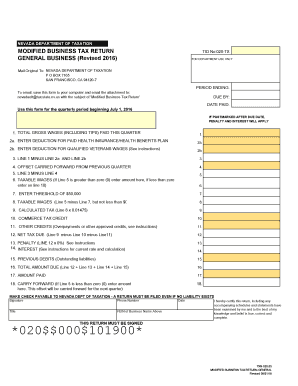

Email the amended return along with any additional documentation to nevadaolttaxstatenvus OR mail your amended return to. All forms and tax payments are due no later than the last day of the month following the end of the quarter. Net Tax Due - Line 7 minus Line 8.

Quarter ended September 30 return is due by October 31 Late filing penalty up to 10 NRS 360417. Automatic Shelf Registration Statement of Securities of. We recommend that you obtain a Business License Compliance Package BLCP.

Home Uncategorized nv modified business tax login. Modified Business Tax NRS 463370 Gaming License Fees NRS 680B. The default dates for submission are April 30 July 31 October 31 and January 31.

Do you need to submit a Modified Business Tax Return Form in Henderson NV. The Nevada Commerce Tax return is due 45 days following the end of Nevadas fiscal year which ended on June 30 2020. Select the document you want to sign and click upload.

Apartments For Rent in Las Vegas. We recommend that you obtain a Business License Compliance Package BLCP. SB 483 of the 2015 Legislative Session became effective July 1 2015 and changes the tax rate to 1475 from 117.

The default dates for submission are. Department of Taxation 1550 College Parkway Suite 115. The Commerce Tax return is due 45 days following the end of the fiscal year.

For additional questions about the Nevada Modified Business Tax see the following page. This is the standard quarterly return for reporting the Modified Business Tax for General Businesses. Generally the due date is August 14.

What is the Nevada Modified Business Tax. We provide sales tax rate databases for businesses who manage their own. Nv modified business tax login.

The direct or indirect ownership control or possession of 50 or more of the ownership interest. Easily fill out PDF blank edit and sign them. Modified business tax nevada due date.

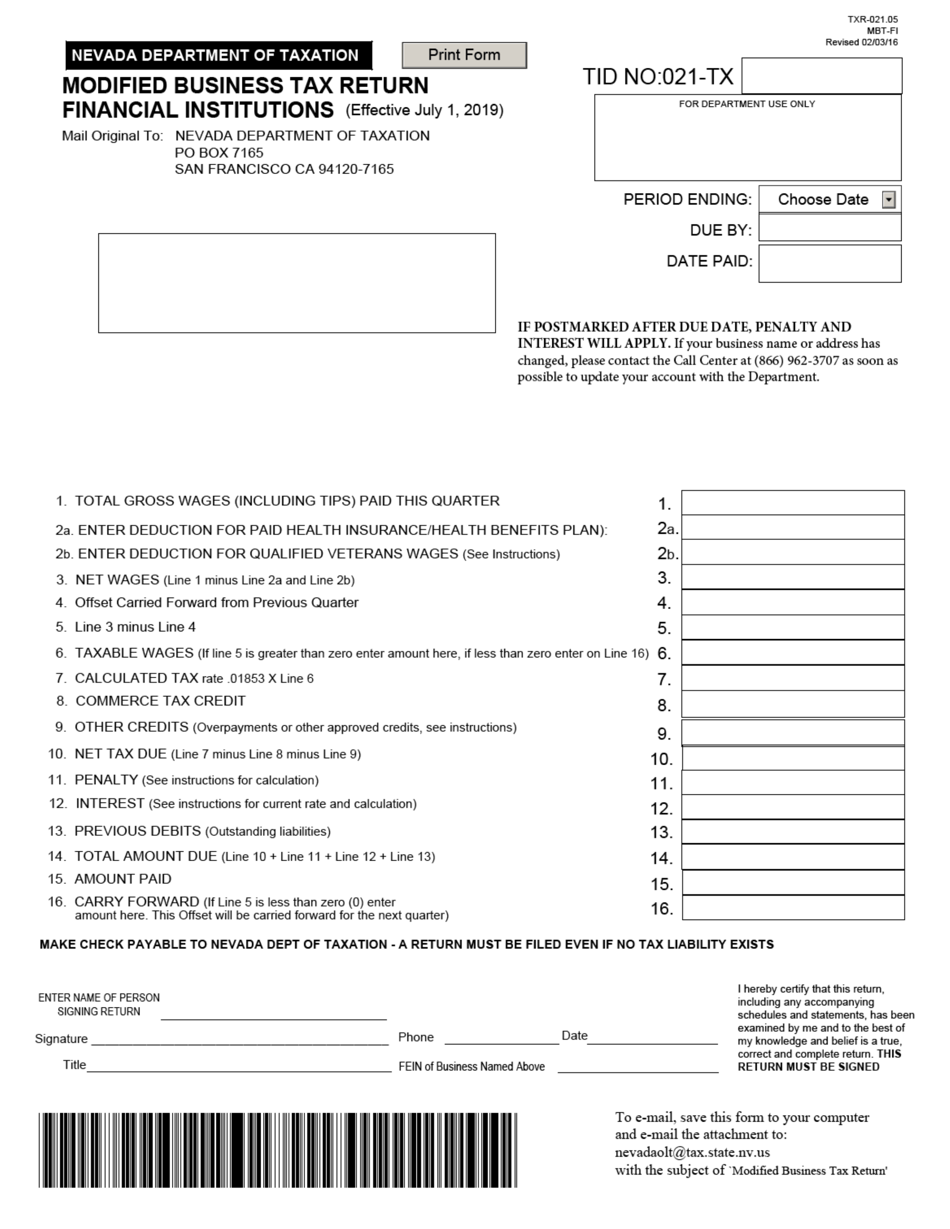

On June 10 2015 Governor Sandoval signed the bill 1 thus enacting a new commerce tax effective July 1 2015 applicable to each business entity engaged in. Effective july 1 2019 the tax rate changes to 1853 from 20. Additionally the new threshold is decreased from.

Simplify Nevada sales tax compliance. PO Box 7165 San Francisco CA 94120-7165. Nevada Commerce Tax due August 14 2020.

Wednesday March 30 2022. Nevada Revised Statute 363B120 provides an abatement of the Modified Business Tax for qualifying businesses. Complete Nevada Modified Business Tax Form 2020 online with US Legal Forms.

2022 Federal Tax Deadlines For Your Small Business

How To File And Pay Sales Tax In Nevada Taxvalet

How To File And Pay Sales Tax In Nevada Taxvalet

Corporate Tax Return Due Date 2019

Form Txr 021 05 Mbt Fi Download Fillable Pdf Or Fill Online Modified Business Tax Return Financial Institutions Nevada Templateroller

State Of Nevada Department Of Taxation Ppt Video Online Download

Nevada Modified Business Tax 2020 2022 Fill And Sign Printable Template Online Us Legal Forms

What Is The Business Tax Rate In Nevada

Form Txr 02 01 Download Fillable Pdf Or Fill Online Consumer Use Tax Return Nevada Templateroller

Shrinking The Delaware Tax Loophole Other U S States To Incorporate Your Business

State Of Nevada Department Of Taxation Ppt Video Online Download